LV bosses defend £530million sale to US private equity firm

LV bosses insist £530million sale of historic UK insurer to US private equity firm is only way to keep business running despite mounting fury

- Bosses at the life insurer have been criticised for backing offer from Bain Capital

- Would mean the 178-year-old firm is no longer a mutual owned by its members

- Board members have attempted to justify decision by showing their workings

Under-fire LV bosses today insisted their £530million sale of the historic UK life insurer to an American private equity firm is the only way to keep the business running.

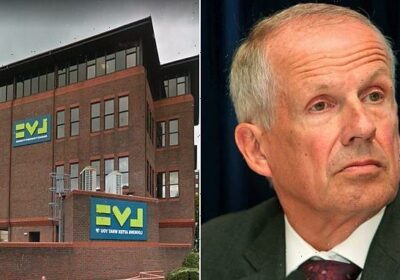

Bosses at the Bournemouth-based company, formerly known as Liverpool Victoria, have faced heavy criticism for proposing members accept an offer from Bain Capital.

The sale would mean the 178-year-old firm is no longer a mutual owned by its members, while concerns have been raised about the possibility of job cuts.

LV chairman Alan Cook said the LV board wanted to show how it arrived at the decision to sell LV

But today LV said it was the only option to keep the business running as it attempted to show its workings.

Senior independent director David Barral said: ‘Our board carried out a careful and detailed strategic review of LV in 2020.

‘We examined all the options, drawing on our own wide business and transaction experience and that of our professional advisers.

‘We all came to the firm conclusion it would not be fair for us to ask our With-profit members to finance a future that requires significant investment, which many would not benefit from.’

Chairman Alan Cook said: ‘There have been numerous theories and opinions about the process and decision.

‘So that members can vote with the facts in front of them, we are showing the analysis we did and the conclusions we reached.’

He pointed out that LV’s sale of its general insurance business to Allianz for £1.1 billion to prop up the organisation was not enough for the life and pensions business to run successfully.

LV carried out a strategic review in 2020, finding the business was ‘sub-scale… with an insufficiently strong capital structure and a loss-making new business unit, in need of investment’.

The firm added that trying to continue running a ‘business as usual’ strategy was not fair for members given the need for investments, with more than £100 million needed to upgrade systems and customer services.

Members would have to stump up the cash themselves to fund a reorganisation as the risks were ‘too high’.

Bain would invest £212 million and hand out £533 million to 271,000 LV main fund with-profit members, it added.

Bosses attempted to defend the £100 one-off payment to members from the sale, claiming the full amount being returned to them will be £533 million ‘over time’ versus £404 million under a ‘business as usual’ position if it remained successful.

The sale would mean the 178-year-old firm is no longer a mutual owned by its members, while concerns have been raised about the possibility of job cuts

Continuing to run the business would also have risked current members not seeing the benefit of investment before their policies matured, with the membership base at the mutual falling 40% since 2017, it added.

One option was to close the business, but bosses said this would create significant job losses and costs involved.

LV received 12 bids for the business and said the Bain offer was accepted by the board unanimously, with the private equity firm the only one to preserve the ‘brand, heritage and values’ of the mutual, bosses said – including offices in Bournemouth, Hitchin and Exeter.

The firm said: ‘These benefits were not available under other external proposals.’

Rival mutual Royal London has attempted to disrupt the deal but LV said the proposal would see the business split up and result in redundancies.

Boss Mark Hartigan told the PA news agency last week that he was ‘disappointed’ with the timing.

He added: ‘Royal London had every opportunity to offer a better deal than Bain and they didn’t.’

Source: Read Full Article