Heir to JCB launches multi-million pound lawsuit against former friend

Heir to JCB fortune launches multi-million pound lawsuit against his former best friend and business partner amid bitter spending fall-out

- Jo Bamford, the son of JCB boss, is suing his former best friend Joseph Manheim

- The matter is related to ownership of a business they set up together in the US

- Mr Bamford accused Mr Manheim of taking £4.4million out of the business

- Mr Bamford has admitted ordering cannabis online and sending ‘explicit photos’

- JCB and Lord Frost’s lawyers said proceedings had no connection to firm or him

An heir to the JCB empire is locked in a multi-million pound court battle which is said to have seen him admit ordering cannabis online and sending ‘explicit photographs’.

Jo Bamford, the son of billionaire boss and Tory donor Lord Bamford, is suing his former best friend in a row over the ownership of a company in the US.

The case has seen Mr Bamford’s business dealings come under scrutiny, and has revealed alleged tensions in one of Britain’s most powerful industrial families.

Mr Bamford, 44, is a ‘green entrepreneur’ whose companies have won taxpayer-funded contracts worth nearly £80million for zero-emission buses in England and Northern Ireland.

But in the US he is in a legal dispute with the man who had been his best friend since his teenage years, Joseph Manheim, over a firm they set up together.

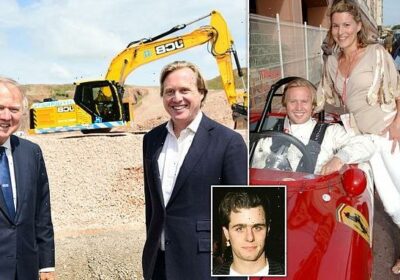

Jo Bamford (pictured right with Alex Gore Brown), the son of billionaire JCB boss and Tory donor Lord Bamford, is locked in a multi-million pound court battle with his former best friend

The pair were once so close that Mr Manheim and his wife holidayed with Mr Bamford while on their honeymoon. They were Godfathers to each other’s children.

Mr Bamford and another director have accused Mr Manheim of ‘surreptitiously’ seizing control of the business and then taking £4.4million out of it.

He denies the allegation and accuses Mr Bamford of attempting to use the case to carry out a ‘bloodless coup’ to seize control of the company himself.

In his evidence, Mr Bamford admitted he had used company email accounts to order cannabis via the website Craigslist, and that he had used his work email to send ‘inappropriate, explicit photographs’, The Guardian reported.

He and another director accused Mr Manheim of using company funds for outings to a Philadelphia strip club called Delilah’s Den, to lease a Porsche and to cover the cost of playing in a polo match in Argentina. In court, Mr Bamford confirmed that he had ‘regretfully left the family firm’ in 2016 after a ‘difficult and painful conversation’ with his father.

Lord Bamford, 76, is one of Britain’s most successful industrialists and his fortune has been estimated at £4.6billion.

The Guardian reported that Mr Bamford told the court: ‘My dad didn’t want to stop running the business, and I didn’t want him to stop running the business. And I really didn’t want to be Prince Charles, I didn’t want to be waiting for the rest of my life. I wanted to go and run my own business.’

The court case centres on a company Mr Manheim founded in 2012 with start-up capital provided by Mr Bamford.

Mr Bamford (left) is pictured alongside his father, the JCB boss Lord Bamford. Lawyers acting jointly for JCB, Lord Bamford and Jo Bamford said the US legal proceedings had no connection with either the digger firm or the peer

The firm, Delaware Valley Regional Center, helped wealthy Far Eastern investors fast-track visas to live and work in the US, in exchange for investments in infrastructure projects.

But in 2018 Mr Manheim and the other directors agreed to dismiss Mr Bamford from the board of a holding company. Mr Bamford, a classic car fan, claims he was unlawfully removed. He is seeking damages and to have Mr Manheim removed from the board and replaced by a trustee.

Both men deny any wrongdoing, and a final judgment on the case is not expected until next year.

Lawyers acting jointly for JCB, Lord Bamford and Jo Bamford said the US legal proceedings had no connection with either the digger firm or the peer.

Source: Read Full Article